Forex tester: che cos’è e quando utilizzarlo

Lo studio del mercato valutario, degli aspetti economici e finanziari che lo influenzano, della terminologia, delle strategie e di tutti gli aspetti teorici che riguardano il Forex Market sono oggi facilmente reperibili.

Libri ed e-book, dispense fornite dai broker, corsi di aggiornamento e molto altro permettono di formarsi un’ottima base teorica su cui poter lavorare. Per quanto riguarda invece l’aspetto pratico, molti trader, soprattutto quelli alle prime armi, si trovano spesso in difficoltà perché gli strumenti per testare la loro abilità pratica sono molto di meno.

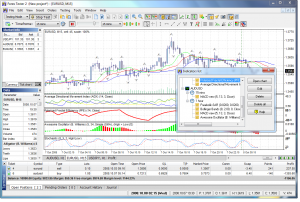

Tra i migliori, tuttavia, c’è Forex tester, un simulatore che permette di allenarsi in tutta sicurezza, testando strategie e tecniche di trading senza rischiare di perdere il proprio capitale per errori tipici degli inesperti.

Come ogni software, Forex tester presenta diverse versioni, sempre più aggiornate, offrendo ai trader che ne fanno uso la possibilità di avere sempre più possibilità di studio.

Forex tester o conti demo?

Quando si apre un account presso un broker, una reale possibilità di allenamento al trading è data dai conti demo. Si tratta di un modo molto utile per comprendere come funziona il mercato valutario e, allo stesso tempo, per provare le proprie strategie senza rischiare nulla.

Come si fa allora a decidere se sia meglio utilizzare l’account demo o un simulatore come Forex tester? Va subito specificato che Forex tester è uno strumento più completo rispetto ai conti demo perché offre la possibilità di caricare molte più situazioni di mercato.

Mentre un conto demo, infatti, segue il mercato giornaliero, con gli stessi tempi e modalità permettendo quindi di comprendere come funziona realmente il Forex, ma potendo utilizzare solo quelle determinate situazioni, un simulatore offre la possibilità di testare molti più aspetti di trading, non rispettando i reali tempi del Forex. Si possono ad esempio effettuare simulazioni su dati storici, offrendo quindi la possibilità di imparare anche dalle situazioni passate come muoversi in caso di crisi di mercato o di situazioni particolarmente favorevoli. Inoltre, si può tornare più volte sugli stessi dati per poter testare, per una stessa situazione, strategie differenti, per comprendere al meglio come muoversi e come sia meglio agire.

Forex tester e il trading automatico

La versione più aggiornata di Forex tester permette di scegliere tra due differenti possibilità, ossia la versione lite, che permette di effettuare il classico trading, da seguire ed impostare regolarmente, oppure la versione pro, che offre anche la possibilità di testare il trading automatico.

La possibilità di avere un simulatore per il trading automatico non è molto facile da trovare e in questo Forex tester si distingue dalla maggior parte dei simulatori che, appunto, permettono solo di effettuare simulazioni ‘manuali’.

Si tratta di una possibilità importante, visto che i Forex robot vengono sempre più spesso utilizzati nel trading, ma spesso senza sapere bene come impostare le proprie strategie per un trading automatico. Da questo punto di vista si può dire che Forex tester è un software molto completo.